Gold Price Forecast | Today's Market Sentiments

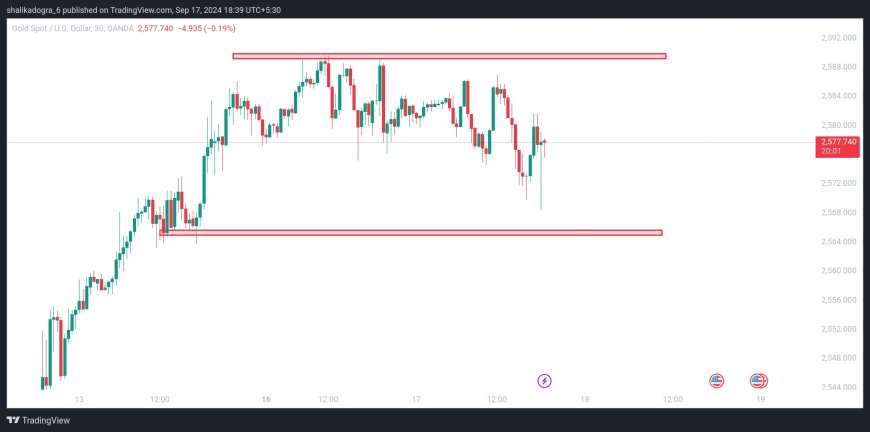

Gold continues to trade in a short-term uptrend, with prices consolidating above key support levels. Long trades should be considered on corrections at specified support zones, while a consolidation below support may indicate a reversal and shorting opportunities.

1. Gold Market Outlook | Consolidation Above Key Levels and Trading Opportunities

Gold Continues Short-Term Uptrend with Key Resistance and Support Levels in Focus

Gold prices remain in a short-term uptrend, with consolidation occurring above the critical Gold Zone at 2571 – 2566. This consolidation signals a potential move toward the next bullish target range at Target Zone, 2629 – 2619. Traders should keep an eye on this level for potential long trade opportunities.

To capitalize on corrections, consider entering long positions at the support levels of 2537 – 2531 and 2510 – 2502, targeting this week's highs. A successful breach and consolidation below these support levels may signal the reversal of the uptrend, opening the door for short trades.

For traders looking for a tactical advantage, monitoring the price action around these zones can offer a clearer direction for both short and long trades in this dynamic market.

What's Your Reaction?